Homeowners Insurance in and around Berea

Looking for homeowners insurance in Berea?

Help cover your home

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

Your home and property have monetary value. Your home is more than just a roof over your head. It’s all the memories packed in and attached to it. Doing what you can to keep your home protected just makes sense! That’s why the most sensible step is to get outstanding homeowners insurance from State Farm.

Looking for homeowners insurance in Berea?

Help cover your home

State Farm Can Cover Your Home, Too

State Farm's homeowners insurance secures your home and your memorabilia. Agent Ryan Devins is here to help provide you with coverage with your specific needs in mind.

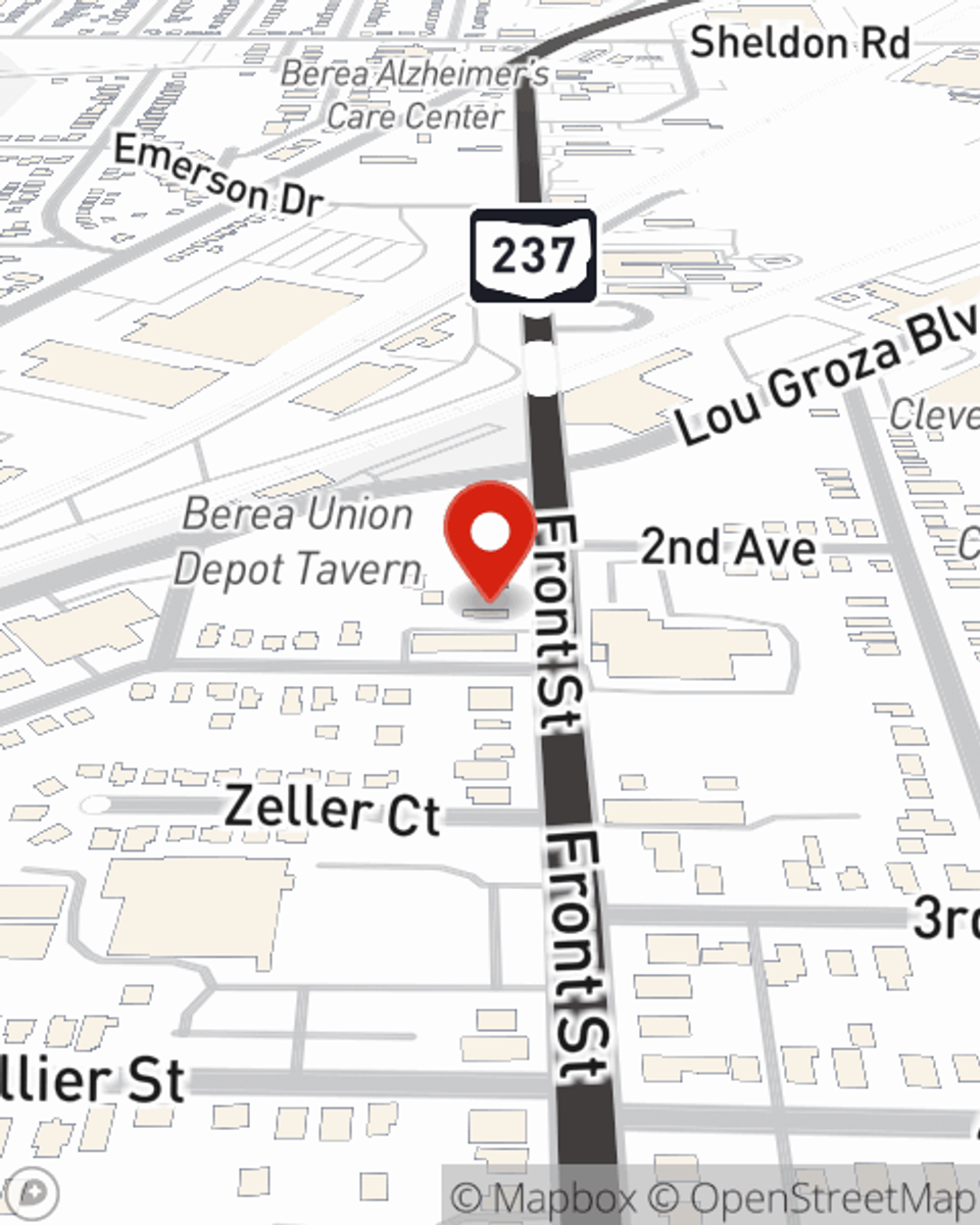

More homeowners choose State Farm® as their home insurance company over any other insurer. Berea homeowners, are you ready to find out what a State Farm policy can do for you? Visit State Farm Agent Ryan Devins today.

Have More Questions About Homeowners Insurance?

Call Ryan at (440) 243-7926 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What to do during a tornado

What to do during a tornado

You see the alert. Your area is under a tornado watch, or even worse, a tornado warning. Know the differences between them, and what to do during a tornado.

Tips to safely deep fry a turkey

Tips to safely deep fry a turkey

Review these safe turkey frying tips and take precautions to help protect yourself, your guests and your home this holiday season.

Ryan Devins

State Farm® Insurance AgentSimple Insights®

What to do during a tornado

What to do during a tornado

You see the alert. Your area is under a tornado watch, or even worse, a tornado warning. Know the differences between them, and what to do during a tornado.

Tips to safely deep fry a turkey

Tips to safely deep fry a turkey

Review these safe turkey frying tips and take precautions to help protect yourself, your guests and your home this holiday season.